In this country, housing prices have increased by almost 100 percent. Prices out of reach

The prices of flats and houses in Turkey jumped by 96% during the year. the Turkish central bank said. There is still very high inflation in the country, which is driving the increase in prices on the real estate market. It is the worst in large cities, especially in the capital of the country.

According to a report by Turkey’s central bank, real estate prices in Ankara, the capital of the country, have gone up by 106 percent. during the year. 100 percent In 2017, prices increased in Izmir, while in Istanbul, the largest Turkish city, flats and houses increased by 85%.

Inflation effect

In June, the average price per square meter in Turkey was 600 lira, or the equivalent of PLN 3,725. Consumer inflation, according to the latest available data, amounted to over 42 percent. According to experts from the ENAG group, the actual data is much worse. Inflation in Turkey is estimated to be as high as 122 percent.

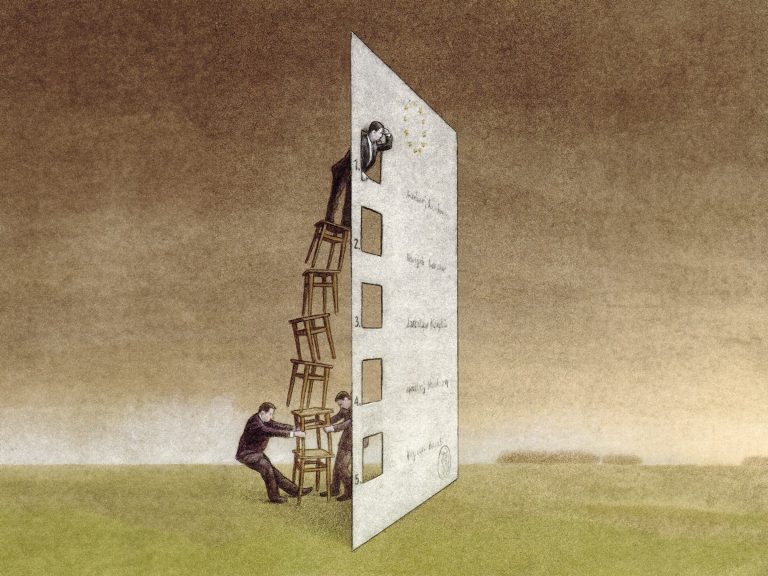

It is to the very high inflation that experts attribute the record-breaking jump in real estate prices. Wealthier people try to protect their savings by buying real estate, and high demand drives up prices.

Inflation in Turkey

Inflation in Turkey remains extremely high. The last time the inhabitants of the country could boast a single-digit level at the end of 2019. After that, only higher levels were recorded. The peak occurred in October last year, when inflation exceeded 85.5 percent. on a year-on-year basis. It was the highest reading since 1998. Food prices increased by 99 percent. year-on-year, and by 85 per cent. the costs of rents and other charges related to housing increased.

As the main factors of the record inflation in Turkey, experts pointed out, among others, rising energy prices and the collapse of the national currency. Despite such high inflation, Turkey’s central bank decided to lower the main interest rate. The easing of monetary policy was perceived by investors as a result of pressure from Turkish President Recep Erdogan, who is famous for being an opponent of high interest rates.